Swiss franc

| |||||

| ISO 4217 | |||||

| Code | CHF (numeric: 756) | ||||

| Subunit | 0.01 | ||||

| Unit | |||||

| Plural | |||||

| Symbol | None. Abbreviations used: | ||||

| Nickname |

Füfräppler for a 5 centimes coin; Zëhräppler for a 10 centimes coin; Zwänzgräppler for a 20 centimes coin;[1] Stutz [2] or Franke[3] for a 1 franc coin or change in general; Füüfliiber for a 5 francs coin;[4] Rappe and Batze are specifically used for coin below 1 franc, but also figuratively for change in general [5][6]

| ||||

| Denominations | |||||

| Subunit | |||||

| 1⁄100 | |||||

| Banknotes | |||||

| Freq. used | 10, 20, 50, 100, 200, 1000 Francs | ||||

| Coins | |||||

| Freq. used | 5, 10, 20 Centimes, 1⁄2, 1, 2, 5 Francs | ||||

| Demographics | |||||

| Official user(s) | |||||

| Unofficial user(s) | |||||

| Issuance | |||||

| Central bank | Swiss National Bank | ||||

| Website | www | ||||

| Printer | Orell Füssli | ||||

| Website | www | ||||

| Mint | Swissmint | ||||

| Website | www | ||||

| Valuation | |||||

| Inflation | 2.1% in 2023 | ||||

| Source | Statistik Schweiz | ||||

| Method | Consumer price index | ||||

The Swiss franc,[c] or simply the franc,[d] is the currency and legal tender of Switzerland and Liechtenstein. It is also legal tender in the Italian exclave of Campione d'Italia which is surrounded by Swiss territory.[12] The Swiss National Bank (SNB) issues banknotes and the federal mint Swissmint issues coins.

It is also designated through currency signs Fr.[e] (in German language), fr. (in French, Italian, Romansh languages), as well as in any other language, or internationally as CHF which stands for Confoederatio Helvetica Franc.[7][14][15] This acronym also serves as the ISO 4217 currency code, used by banks and financial institutions.

The smaller denomination, a hundredth of a franc, is a Rappen (Rp.) in German, centime (c.) in French, centesimo (ct.) in Italian, and rap (rp.) in Romansh.

The official symbols Fr. (German symbol) and fr. (Latin languages) are widely used by businesses and advertisers, also for the English language. According to Art. 1 SR/RS 941.101 of the federal law collection the internationally official abbreviation – besides the national languages – however is CHF,[7] also in English; respective guides also request to use the ISO 4217 code.[11][8][9][10] The use of SFr. for Swiss Franc and fr.sv. are outdated.[8][9][10] As previously indicated Latinate "CH" stands for Confoederatio Helvetica; given the different languages used in Switzerland, Latin is used for language-neutral inscriptions on its coins.

History

[edit]Before the Helvetic Republic

[edit]

Before 1798, about 75 entities were making coins in Switzerland, including the 25 cantons and half-cantons, 16 cities, and abbeys, resulting in about 860 different coins in circulation, with different values, denominations and monetary systems.[16] However, the origins of a majority of these currencies can be traced to either the French livre tournois (the predecessor of the French franc) or the South German gulden of the 17th century. The new Swiss currencies emerged in the 18th century after Swiss cantons did not follow the pace of depreciations which occurred in France and Germany. However, they mostly existed only in small change as they were little more than community currency, current in one canton but not in the other, and foreign coins like French francs and kronenthalers were more recognized as currency all over Switzerland.[17]

A high-level summary of existing currencies at the end of the 18th century is shown below, including their equivalents in terms of the French écu of 26.67 g fine silver, the South German kronenthaler of 25.71 g fine silver, and Swiss francs of 4.5 g fine silver.[18]

| Unit | Origin | Units per écu |

Units per kronenthaler |

CHF per unit |

|---|---|---|---|---|

| Bern livre | livre | 4.00 | 3.90 | 1.465 F |

| Geneva livre | livre | 3.643 | 3.536 | 1.616 F |

| South German gulden | gulden | 2.80 | 2.70 | 2.116 F |

| Zurich gulden | gulden | 2.50 | 2.45 | 2.332 F |

| Central Swiss gulden | gulden | 3.00 | 2.925 | 1.954 F |

The livre of Bern and most western Swiss cantons like Basel, Aargau, Fribourg, Vaud, Valais, Lausanne, Neuchâtel and Solothurn originated from the French livre tournois.

- The livre was divided into 20 sols, 10 batzen or 40 kreuzer.

- After 1690, 30 Bern batzen equated to either

- a German Reichsthaler (25.984 g fine silver) worth 2 gulden or 120 kreuzer, or

- a French Louis d'Argent, equivalent to the Spanish dollar (24.93 g fine silver), worth 3 livres tournois or 60 sols.

- After 1726, the French écu (laubthaler) of 26+2⁄3 g fine silver was valued at 4 livres or 40 batzen (vs 6 livres tournois in France).[19]

- After 1815, the German kronenthaler (Brabant thaler) of 25+5⁄7 g fine silver was valued at 3.9 livres or 39 batzen (in Neuchâtel, 4.1 livres).

- This livre or frank of 1⁄4 écu was the model for the frank of the Helvetic Republic of 1798–1847.

- Currencies identical to this standard include the Berne thaler, Basel thaler, Fribourg gulden, Neuchâtel gulden, Solothurn thaler and Valais thaler.

Geneva had its own currency, the florin petite monnaie, with 3+1⁄2 florins equal to the livre courant. After 1641, the Spanish dollar was worth 10+1⁄2 florins or 3 livres. Afterwards, the écu was valued at 12+3⁄4 florins or 3+9⁄14 livres, while the kronenthaler was valued at 12+3⁄8 florins or 3+15⁄28 livres. See also Geneva thaler and Geneva genevoise.

Many currencies of central and eastern Switzerland originated from the South German gulden. It was divided into 40 schilling or 60 kreuzer, and the thaler was worth 2 gulden. After 1690, this gulden was worth 1⁄2 a Reichsthaler specie, or 12.992 g fine silver. After 1730, the different guilders of Southern Germany and Switzerland fragmented under varying rates of depreciation. The South German gulden, worth 1⁄24 a Cologne mark (233.856 g) of fine silver, also applied to the Swiss cantons of St. Gallen, Appenzell, Schaffhausen and Thurgau. The French écu was valued at 2.8 gulden, while the kronenthaler was valued at 2.7 gulden. See St. Gallen thaler.

The cantons of Zurich, Schwyz and Glarus, however, maintained a stronger gulden worth 1⁄22 a Cologne mark of fine silver. The French écu was valued at 2+1⁄2 gulden, while the kronenthaler was valued at 2+18⁄40 gulden; see Zürich thaler and Schwyz gulden. On the other hand, the central Swiss cantons of Luzern, Uri, Zug and Unterwalden maintained a weaker gulden vs the South German gulden. The French écu was valued at 3 gulden, while the kronenthaler was valued at 2+37⁄40 gulden (see Luzern gulden).

-

Bernese Rollbatzen, 15th century

-

Basel taler (1690)

-

Zürich taler (1768)

Helvetic Republic to Regeneration, 1798–1847

[edit]In 1798, the Helvetic Republic introduced the franc or frank, modelled on the Bern livre worth 1⁄4 the écu, subdivided into 10 batzen or 100 rappen (centimes). It contained 6+2⁄3 grams of fine silver and was initially worth 1+1⁄2 livres tournois or 1.48 French francs.[20]

-

32 Franken gold coin of the Helvetic Republic (1800)

-

40 Batzen coin of Vaud (1812)

-

Bernese Konkordatsbatzen (1826)

-

1 franc coin of Vaud (1845)

This franc was issued until the end of the Helvetic Republic in 1803, but served as the model for the currencies of several cantons in the Mediation period (1803–1814). These 19 cantonal currencies were the Appenzell frank, Argovia frank, Basel frank, Berne frank, Fribourg frank, Geneva franc, Glarus frank, Graubünden frank, Luzern frank, St. Gallen frank, Schaffhausen frank, Schwyz frank, Solothurn frank, Thurgau frank, Ticino franco, Unterwalden frank, Uri frank, Vaud franc, and Zürich frank.

After 1815, the restored Swiss Confederacy attempted to simplify the system of currencies once again. As of 1820, a total of 8,000 distinct coins were current in Switzerland: those issued by cantons, cities, abbeys, and principalities or lordships, mixed with surviving coins of the Helvetic Republic and the pre-1798 Helvetic Republic. In 1825, the cantons of Bern, Basel, Fribourg, Solothurn, Aargau, and Vaud formed a monetary concordate, issuing standardised coins, the so-called Konkordanzbatzen, still carrying the coat of arms of the issuing canton, but interchangeable and identical in value. The reverse side of the coin displayed a Swiss cross with the letter C in the center.

Franc of the Swiss Confederation, 1850–present

[edit]The Konkordanzbatzen among the Swiss cantons agreeing on an exclusive issue of currency in francs and batzen failed to replace the over 8,000 different coins and notes in circulation. Despite introduction of the first Swiss franc, the South German kronenthaler became the more desirable coin to use in the 19th century, and it was still quoted in pre-1798 currency equivalents. Furthermore, less than 15% of Swiss money in circulation was in local currency, since French and German gold and silver trade coins proved to be more desirable means of exchange.[17] A final problem was that the first Swiss franc was based on the French écu which was being phased out by France in the 19th century.

To solve this problem, the new Swiss Federal Constitution of 1848 specified that the federal government would be the only entity allowed to issue money in Switzerland. This was followed two years later by the first Federal Coinage Act, passed by the Federal Assembly on 7 May 1850, which introduced the franc as the monetary unit of Switzerland.

The Swiss franc was introduced at par with the French franc, at 4.5 g fine silver or 9⁄31 g = 0.29032 g fine gold (ratio 15.5). The currencies of the Swiss cantons were converted to Swiss francs by first restating their equivalents in German kronenthaler (écu brabant) of 25+5⁄7 grams fine silver, and then to Swiss francs at the rate of 7 écu brabant = 40 Swiss francs. The first franc worth 1⁄4th the French écu was converted at 1.4597 Swiss francs.[21]

In 1865, France, Belgium, Italy, and Switzerland formed the Latin Monetary Union, in which they agreed to value their national currencies to a standard of 4.5 grams of fine silver or 0.290322 grams fine gold, equivalent to US$1 = CHF 5.1826 until 1934. Even after the monetary union faded away in the 1920s and officially ended in 1927, the Swiss franc remained on that standard until 27 September 1936, when it suffered its sole devaluation during the Great Depression. Following the devaluations of the British pound, U.S. dollar and French franc, the Swiss franc was devalued 30% to 0.20322 grams fine gold, equivalent to US$1 = CHF 4.37295.[22] In 1945, Switzerland joined the Bretton Woods system with its exchange rate to the dollar fixed until 1970.[23]

The Swiss franc has historically been considered a safe-haven currency, with a legal requirement that a minimum of 40% be backed by gold reserves.[24] However, this link to gold, which dated from the 1920s, was terminated on 1 May 2000 following a referendum, making the franc fiat money.[25][26] By March 2005, following a gold-selling program, the Swiss National Bank held 1,290 tonnes of gold in reserves, which equated to 20% of its assets.[27]

In November 2014, the referendum on the "Swiss Gold Initiative", which proposed a restoration of 20% gold backing for the Swiss franc, was voted down.[28]

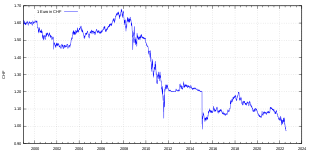

2011–2014: Big movements and capping

[edit]

The onset of the Greek sovereign debt crisis resulted in a strong appreciation in the value of the Swiss franc, past US$1.10 (CHF 0.91 per USD) in March 2011, to US$1.20 (CHF 0.833 per USD) in June 2011, and to US$1.30 (CHF 0.769 per USD) in August 2011.[29] This prompted the Swiss National Bank to boost the franc's liquidity to try to counter its "massive overvaluation".[30] The Economist argued that its Big Mac Index in July 2011 indicated an overvaluation of 98% over the dollar, and cited Swiss companies releasing profit warnings and threatening to move operations out of the country due to the strength of the franc.[31] Demand for francs and franc-denominated assets was so strong that nominal short-term Swiss interest rates became negative.[32]

On 6 September 2011, the day after the franc traded at 1.11 CHF/€ and appeared headed to parity with the euro, the SNB set a minimum exchange rate of 1.20 CHF to the euro ('capping' the franc's appreciation), saying "the value of the franc is a threat to the economy",[33] and that it was "prepared to buy foreign currency in unlimited quantities".[34] In response to this announcement the franc fell against the euro from 1.11 to 1.20 CHF, against the U.S. dollar from 0.787 to 0.856 CHF, and against all 16 of the most active currencies on the same day.[35] It was the largest plunge of the franc ever against the euro.[36]

The intervention stunned currency traders, since the franc had long been regarded as a safe haven.[37][38] The SNB had previously set an exchange rate target in 1978 against the Deutsche mark and maintained it,[clarification needed] although at the cost of high inflation.[39] Until mid-January 2015, the franc continued to trade below the target level set by the SNB,[40] though the ceiling was broken at least once on 5 April 2012, albeit briefly.[41]

End of capping

[edit]On 18 December 2014, the Swiss central bank introduced a negative interest rate on bank deposits to support its CHF ceiling.[42] However, with the euro declining in value over the following weeks, in a move dubbed Francogeddon[43][44][45][46] for its effect on markets, the Swiss National Bank abandoned the ceiling on 15 January 2015, and the franc promptly increased in value compared with the euro by 30%, although this only lasted a few minutes before part of the increase was reversed.[47] The move was not announced in advance and resulted in "turmoil" in stock and currency markets.[48] By the close of trading that day, the franc was up 23% against the euro and 21% against the US dollar.[49] The full daily appreciation of the franc was equivalent to $31,000 per single futures contract: more than the market had moved collectively[clarification needed] in the previous thousand days.[50] The key CHF interest rate was also lowered from −0.25% to −0.75%, meaning depositors would be paying an increased fee to keep their funds in a Swiss bank account. This devaluation of the euro against the franc was expected to hurt Switzerland's large export industry. The Swatch Group, for example, saw its shares drop 15% (in Swiss franc terms) with the announcements[47] so that the share price may have increased on that day in terms of other major currencies.

The large and unexpected jump caused major losses for some currency traders. Alpari, a Russian-owned spread betting firm established in the UK, temporarily declared insolvency before announcing its desire to be acquired (and later denied rumours of an acquisition) by FXCM.[51][52] FXCM was bailed out by its parent company.[53] Saxo Bank of Denmark reported losses on 19 January 2015.[54] New Zealand foreign exchange broker Global Brokers NZ announced it "could no longer meet New Zealand regulators' minimum capital requirements" and terminated its business.[55]

Coins

[edit]Coins before the Helvetic Republic

[edit]Coins before 1700 were based on either the French livre tournois system (in Louis d'Argent, Louis d'Or and fractions) or the South German gulden system (in Reichsthalers, florins and fractions). After 1700 Swiss cantonal currencies diverged from the value of the French and German units. However, they mostly existed only in small change as they were a mere community currency, current in one canton but not in the other, and foreign coins like French francs and Brabant dollars were more recognized as currency all over Switzerland.[17]

Coins of the Helvetic Republic

[edit]

Between 1798 and 1803, billon coins were issued in denominations of 1 centime, 1⁄2 batzen, and 1 batzen. Silver coins were issued for 10, 20 and 40 batzen (also denominated 4 francs), matching with French coins worth 1⁄4, 1⁄2 and 1 écu. Gold 16- and 32-franc coins were issued in 1800, also matching with French coins worth 24 and 48 livres tournois.[56]

Coins of the Swiss Confederation

[edit]In 1850, coins were introduced in denominations of 1 centime, 2 centimes, 5 centimes, 10 centimes 20 centimes, 1⁄2 franc, 1 franc, 2 francs, and 5 francs. The 1 centime and 2 centime coins were struck in bronze; the 5 centimes, 10 centime and 20 centime in billon (with 5% to 15% silver content); and the 1⁄2 franc, 1 franc, 2 franc and 5 franc in .900 fine silver. Between 1860 and 1863, .800 fine silver was used, before the standard used in France of .835 fineness was adopted for all silver coins except the 5 francs (which remained .900 fineness) in 1875. In 1879, billon was replaced by cupronickel in the 5 centime and 10 centime coins and by nickel in the 20 centime piece.[57] Gold coins in denominations of 10, 20, and 100 francs, known as Vreneli, circulated until 1936.[58]

Both world wars only had a small effect on the Swiss coinage, with brass and zinc coins temporarily being issued. In 1931, the mass of the 5 franc coin was reduced from 25 grams to 15, with the silver content reduced to .835 fineness. The next year, nickel replaced cupronickel in the 5 centime and 10 centime coins.[59]

In the late 1960s, the prices of internationally traded commodities rose significantly. A silver coin's metal value exceeded its monetary value, and many were being sent abroad for melting, which prompted the federal government to make this practice illegal.[60] The statute was of little effect, and the melting of francs only subsided when the collectible value of the remaining francs again exceeded their material value.[citation needed]

The 1 centime coin was still produced until 2006, albeit in ever decreasing quantities, but its importance declined. Those who could justify the use of 1 centime coins for monetary purposes could obtain them at face value; any other user (such as collectors) had to pay an additional four centimes per coin to cover the production costs, which had exceeded the actual face value of the coin for many years. The coin fell into disuse in the late 1970s and early 1980s, but was only officially fully withdrawn from circulation and declared to be no longer legal tender on 1 January 2007. The long-forgotten 2 centime coin, not minted since 1974, was demonetized on 1 January 1978.[59]

The designs of the coins have changed very little since 1879. Among the notable changes were new designs for the 5 francs coins in 1888, 1922, 1924 (minor), and 1931 (mostly just a size reduction). A new design for the bronze coins was used from 1948. Coins depicting a ring of stars (such as the 1 franc coin seen beside this paragraph) were altered from 22 stars to 23 stars in 1983; since the stars represent the Swiss cantons, the design was updated when in 1979 Jura seceded from the Canton of Bern and became the 23rd canton of the Swiss Confederation.[59]

The 10 centime coins from 1879 onwards (except the years 1918–19 and 1932–1939) have had the same composition, size, and design to present and are still legal tender and found in circulation.[59] For this, the coin entered the Guinness Book of Records as the oldest original currency in circulation.[61]

All Swiss coins are language-neutral with respect to Switzerland's four national languages, featuring only numerals, the abbreviation "Fr." for franc, and the Latin phrases Helvetia or Confœderatio Helvetica (depending on the denomination) or the inscription Libertas (Roman goddess of liberty) on the small coins. The name of the artist is present on the coins with the standing Helvetia and the herder.

In addition to these general-circulation coins, numerous series of commemorative coins have been issued, as well as silver and gold coins. These coins are no longer legal tender, but can in theory be exchanged at face value at post offices, and at national and cantonal banks,[62] although their metal or collectors' value equals or exceeds their face value.

| Value | Diameter (mm) |

Thickness (mm) |

Mass (g) |

Composition | Remarks |

|---|---|---|---|---|---|

| 5 centimes | 17.15 | 1.25 | 1.8 | Aluminium bronze | Made in cupronickel or pure nickel until 1980 |

| 10 centimes | 19.15 | 1.45 | 3 | Cupronickel | Made in current minting since 1879 |

| 20 centimes | 21.05 | 1.65 | 4 | Cupronickel | |

| 1⁄2 franc | 18.20 | 1.25 | 2.2 | Cupronickel | In silver until 1967 |

| 1 franc | 23.20 | 1.55 | 4.4 | Cupronickel | In silver until 1967 |

| 2 francs | 27.40 | 2.15 | 8.8 | Cupronickel | In silver until 1967 |

| 5 francs | 31.45 | 2.35 | 13.2 | Cupronickel | In silver until 1967 and in 1969; 25 g mass until 1930 |

Banknotes

[edit]

In 1907, the Swiss National Bank took over the issuance of banknotes from the cantons and various banks. It introduced denominations of 50, 100, 500 and 1000 francs.[64] Twenty-franc notes were introduced in 1911, followed by 5-franc notes in 1913.[65] In 1914, the Federal Treasury issued paper money in denominations of 5, 10 and 20 francs. These notes were issued in three different versions: French, German and Italian.[66] The State Loan Bank also issued 25-franc notes that year. In 1952, the national bank ceased issuing 5-franc notes but introduced 10-franc notes in 1955. In 1996, 200-franc notes were introduced whilst the 500-franc note was discontinued.

Nine series of banknotes have been printed by the Swiss National Bank, seven of which have been released for use by the general public, the fourth and seventh being reserved and never issued. The sixth series from 1976, designed by Ernst and Ursula Hiestand, depicted persons from the world of science. This series was recalled on 1 May 2000 and is no longer legal tender, but notes can still be exchanged for valid ones of the same face value at any National Bank branch or authorized agent, or mailed in by post to the National Bank in exchange for a bank account deposit. The exchange program originally was due to end on 30 April 2020, after which sixth-series notes would lose all value.[67] As of 2016, 1.1 billion francs' worth of sixth-series notes had not yet been exchanged, even though they had not been legal tender for 16 years and only 4 more years remained to exchange them. To avoid having to expire such large amounts of money in 2020, the Federal Council (cabinet) and National Bank proposed in April 2017 to remove the time limit on exchanges for the sixth and future recalled series.[68][69] As of 2020, this proposal was enacted, so old banknote series will not expire.

The seventh series was printed in 1984, but kept as a "reserve series", ready to be used if, for example, wide counterfeiting of the current series suddenly happened. When the Swiss National Bank decided to develop new security features and to abandon the concept of a reserve series, the details of the seventh series were released and the printed notes were destroyed.[70] The eighth series of banknotes was designed by Jörg Zintzmeyer around the theme of the arts and released starting in 1995. In addition to its new vertical design, this series was different from the previous one on several counts. Probably the most important difference from a practical point of view was that the seldom-used 500-franc note was replaced by a new 200-franc note; this new note has indeed proved more successful than the old 500-franc note.[f] The base colours of the new notes were kept similar to the old ones, except that the 20-franc note was changed from blue to red to prevent a frequent confusion with the 100-franc note, and that the 10-franc note was changed from red to yellow. The size of the notes was changed as well, with all notes from the eighth series having the same height (74 mm), while the widths were changed as well, still increasing with the value of the notes. The new series contain many more security features than the previous ones;[71] many of them are now visibly displayed and have been widely advertised, in contrast with the previous series for which most of the features were kept secret.

| Image | Value | Dimensions | Main colour | Obverse | Date of issue | Date of withdrawal | Remarks | |

|---|---|---|---|---|---|---|---|---|

| Obverse | Reverse | |||||||

|

|

10 francs | 126 × 74 mm | Yellow | Le Corbusier | 8 April 1995 | 30 April 2021 | |

|

|

20 francs | 137 × 74 mm | Red | Arthur Honegger | 1 October 1994 | 30 April 2021 | |

|

|

50 francs | 148 × 74 mm | Green | Sophie Taeuber-Arp | 3 October 1995 | 30 April 2021 | |

|

|

100 francs | 159 × 74 mm | Blue | Alberto Giacometti | 1 October 1998 | 30 April 2021 | |

|

|

200 francs | 170 × 74 mm | Brown | Charles-Ferdinand Ramuz | 1 October 1997 | 30 April 2021 | Replaced the 500-franc banknote in the previous series |

|

|

1000 francs | 181 × 74 mm | Purple | Jacob Burckhardt | 1 April 1998 | 30 April 2021 | |

| These images are to scale at 0.7 pixel per millimetre. For table standards, see the banknote specification table. | ||||||||

All banknotes are quadrilingual, displaying all information in the four national languages. With the eighth series, the banknotes depicting a Germanophone person have German and Romansch on the same side as the picture, whereas banknotes depicting a Francophone or an Italophone person have French and Italian on the same side as the picture. The reverse has the other two languages.

When the fifth series lost its validity at the end of April 2000, the banknotes that had not been exchanged represented a total value of 244.3 million Swiss francs; in accordance with Swiss law, this amount was transferred to the Swiss Fund for Emergency Losses in the Case of Non-insurable Natural Disasters.[73]

In February 2005, a competition was announced for the design of the ninth series, then planned to be released around 2010 on the theme "Switzerland open to the world". The results were announced in November 2005. The National Bank selected the designs of Swiss graphic designer Manuela Pfrunder as the basis of the new series. The first denomination to be issued was the 50-franc note on 12 April 2016. It was followed by the 20-franc note (17 May 2017), the 10-franc note (18 October 2017), the 200-franc note (15 August 2018), the 1000-franc note (5 March 2019), and the 100-franc note (12 September 2019).

All banknotes from the eighth series were withdrawn on 30 April 2021, but, like banknotes of the sixth series withdrawn in 2000, remain indefinitely redeemable at the Swiss National Bank.[74]

| 9th (current) series of Swiss banknotes[75] | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Image | Value | Dimensions | Main colour | Theme (a typically Swiss characteristic) |

Obverse (an action) |

Reverse (a Swiss location and an object) |

Date of issue | ||

| Obverse | Reverse | ||||||||

|

|

10 francs | 70 × 123 mm | Yellow | Switzerland's organisational talent Key motif: Time |

|

|

18 October 2017 | |

|

|

20 francs | 70 × 130 mm | Red | Switzerland's creativity Key motif: Light |

|

|

17 May 2017 | |

|

|

50 francs | 70 × 137 mm | Green | Wealth of experiences Switzerland offers Key motif: Wind |

|

|

12 April 2016 | |

|

|

100 francs | 70 × 144 mm | Blue | Switzerland's humanitarian tradition Key motif: Water |

|

12 September 2019[76] | ||

|

|

200 francs | 70 × 151 mm | Brown | Switzerland's scientific expertise Key motif: Matter |

|

|

22 August 2018[76] | |

|

|

1000 francs | 70 × 158 mm | Purple | Switzerland's communicative flair Key motif: Language |

|

|

13 March 2019[76] | |

| For table standards, see the banknote specification table. | |||||||||

Circulation

[edit]This section needs additional citations for verification. (April 2019) |

| Currency | ISO 4217 code |

Symbols | Proportion of daily volume | Change (2019–2022) | |

|---|---|---|---|---|---|

| April 2019 | April 2022 | ||||

| U.S. dollar | USD | $, US$ | 88.3% | 88.5% | |

| Euro | EUR | € | 32.3% | 30.5% | |

| Japanese yen | JPY | ¥, 円 | 16.8% | 16.7% | |

| Sterling | GBP | £ | 12.8% | 12.9% | |

| Renminbi | CNY | ¥, 圆 | 4.3% | 7.0% | |

| Australian dollar | AUD | $, $A | 6.8% | 6.4% | |

| Canadian dollar | CAD | $, Can$ | 5.0% | 6.2% | |

| Swiss franc | CHF | Fr., fr. | 4.9% | 5.2% | |

| Hong Kong dollar | HKD | $, HK$, 元 | 3.5% | 2.6% | |

| Singapore dollar | SGD | $, S$ | 1.8% | 2.4% | |

| Swedish krona | SEK | kr, Skr | 2.0% | 2.2% | |

| South Korean won | KRW | ₩, 원 | 2.0% | 1.9% | |

| Norwegian krone | NOK | kr, Nkr | 1.8% | 1.7% | |

| New Zealand dollar | NZD | $, $NZ | 2.1% | 1.7% | |

| Indian rupee | INR | ₹ | 1.7% | 1.6% | |

| Mexican peso | MXN | $, Mex$ | 1.7% | 1.5% | |

| New Taiwan dollar | TWD | $, NT$, 圓 | 0.9% | 1.1% | |

| South African rand | ZAR | R | 1.1% | 1.0% | |

| Brazilian real | BRL | R$ | 1.1% | 0.9% | |

| Danish krone | DKK | kr., DKr | 0.6% | 0.7% | |

| Polish złoty | PLN | zł, Zl | 0.6% | 0.7% | |

| Thai baht | THB | ฿, B | 0.5% | 0.4% | |

| Israeli new shekel | ILS | ₪, NIS | 0.3% | 0.4% | |

| Indonesian rupiah | IDR | Rp | 0.4% | 0.4% | |

| Czech koruna | CZK | Kč, CZK | 0.4% | 0.4% | |

| UAE dirham | AED | د.إ, Dh(s) | 0.2% | 0.4% | |

| Turkish lira | TRY | ₺, TL | 1.1% | 0.4% | |

| Hungarian forint | HUF | Ft | 0.4% | 0.3% | |

| Chilean peso | CLP | $, Ch$ | 0.3% | 0.3% | |

| Saudi riyal | SAR | ﷼, SRl(s) | 0.2% | 0.2% | |

| Philippine peso | PHP | ₱ | 0.3% | 0.2% | |

| Malaysian ringgit | MYR | RM | 0.2% | 0.2% | |

| Colombian peso | COP | $, Col$ | 0.2% | 0.2% | |

| Russian ruble | RUB | ₽, руб | 1.1% | 0.2% | |

| Romanian leu | RON | —, leu | 0.1% | 0.1% | |

| Peruvian sol | PEN | S/. | 0.1% | 0.1% | |

| Bahraini dinar | BHD | .د.ب, BD | 0.0% | 0.0% | |

| Bulgarian lev | BGN | лв., lv., lev | 0.0% | 0.0% | |

| Argentine peso | ARS | $, Arg$ | 0.1% | 0.0% | |

| Other currencies | 1.8% | 2.3% | |||

| Total: | 200.0% | 200.0% | |||

The Swiss franc is the currency and legal tender of Switzerland and Liechtenstein and also legal tender in the Italian exclave of Campione d'Italia. Although not formally legal tender in the German exclave of Büsingen am Hochrhein (the sole legal currency is the euro), it is in wide daily use there; with many prices quoted in Swiss francs. The Swiss franc is the only version of the franc still issued in Europe.

As of March 2010, the total value of released Swiss coins and banknotes was 49.664 billion Swiss francs.[78]

| Coins | 10 francs | 20 francs | 50 francs | 100 francs | 200 francs | 500 francs | 1000 francs | Total |

|---|---|---|---|---|---|---|---|---|

| 2,695.4 | 656.7 | 1,416.7 | 1,963.0 | 8,337.4 | 6,828.0 | 129.9 | 27,637.1 | 49,664.0 |

Combinations of up to 100 circulating Swiss coins (not including special or commemorative coins) are legal tender; banknotes are legal tender for any amount.[79]

Current exchange rates

[edit]| Current CHF exchange rates | |

|---|---|

| From Google Finance: | AUD CAD CNY EUR GBP HKD JPY USD TRY |

| From Yahoo! Finance: | AUD CAD CNY EUR GBP HKD JPY USD TRY |

| From XE.com: | AUD CAD CNY EUR GBP HKD JPY USD TRY |

| From OANDA: | AUD CAD CNY EUR GBP HKD JPY USD TRY |

See also

[edit]- Banking in Switzerland

- Economy of Switzerland

- Gold standard

- Hard currency

- Iraqi Swiss dinar, a common name for the old Iraqi currency but not related to Swiss currency.

- Liechtenstein franc

- List of currencies in Europe

Notes

[edit]- ^ The Swiss franc is the official currency and the euro is widely accepted.

- ^ The Swiss franc is widely accepted, although the euro is officially used.

- ^ Swiss Standard German: Schweizer Franken, pronounced [ˈʃvaɪtsər ˈfraŋkn̩] ; French: franc suisse, pronounced [fʁɑ̃ sɥis]; Italian: franco svizzero, pronounced [ˈfraŋko ˈzvittsero]; Romansh: franc svizzer.

- ^ Swiss Standard German: Franken; French: franc; Italian: franco; Romansh: franc.

- ^ Some fonts render the currency sign character "₣" (unicode: U+20A3[13]) as ligatured Fr, following the German language convention for the Swiss Franc. However, most fonts render the character as F with a strikethrough on the lower left, which is the unofficial sign of French Franc.

- ^ The global value of those 200-franc notes in circulation in 2000 (5.1200 billion francs) was larger than the value of the 500-franc notes in 1996 (3.9123 billion), even when these figures are corrected for the global increase in total value of Swiss banknotes in circulation (+9%). Figures from the Monthly Statistical Bulletin of the Swiss National Bank, January 2006.

References

[edit]- ^ "Schweizerisches Idiotikon digital". Schweizerisches Idiotikon (in Swiss German).

- ^ "Schweizerisches Idiotikon digital". Schweizerisches Idiotikon (in Swiss German).

- ^ "Schweizerisches Idiotikon digital". Schweizerisches Idiotikon (in Swiss German).

- ^ "Schweizerisches Idiotikon digital". Schweizerisches Idiotikon (in Swiss German).

- ^ "Schweizerisches Idiotikon digital". Schweizerisches Idiotikon (in Swiss German).

- ^ "Schweizerisches Idiotikon digital". Schweizerisches Idiotikon (in Swiss German).

- ^ a b c d e f g "Art. 1 Amtliche Bezeichnungen und Abkürzungen/Dénominations officielles et abréviations/Denominazioni ufficiali e abbreviazioni SR/RS 941.101 Münzverordnung/Ordonnance sur la monnaie/Ordinanza sulle monete, 12 April 2000 (MünzV/O sur la monnaie/OMon)" (federal act) (in German, French, and Italian). Bern, Switzerland: Federal Council. 1 January 2019. Retrieved 18 July 2019.

- ^ a b c "Schreibweisungen" (PDF) (official site) (in German). Bern, Switzerland: Federal Chancellery. 24 August 2015. pp. 86/87. Retrieved 3 July 2019.

- ^ a b c "Instructions de la Chancellerie fédérale sur la présentation des textes officiels en français" (PDF) (official site) (in French). Bern, Switzerland: Federal Chancellery. 27 May 2016. p. 3. Retrieved 3 July 2019.

- ^ a b c "Istruzioni della Cancelleria federale per la redazione dei testi ufficiali in italiano" (PDF) (official site) (in Italian). Bern, Switzerland: Federal Chancellery. 27 February 2006. p. 29. Retrieved 3 July 2019.

- ^ a b "Style Guides for English-language translators" (PDF) (official site). Bern, Switzerland: Federal Chancellery. 20 September 2017. Retrieved 3 July 2019.

- ^ "High stakes for enclave as Europe's biggest casino goes bust". Yahoo News. Retrieved 18 September 2021.

- ^ U+20A3

- ^ DailyFX. "CHF (Swiss Franc) - Latest News, Analysis and Forex Trading Forecast". www.dailyfx.com. Retrieved 29 August 2022.

- ^ "CHF (Swiss Franc) Definition". Investopedia. Retrieved 29 August 2022.

- ^ LaLiberté.ch Archived 22 February 2011 at the Wayback Machine, (in French) La Liberté, 9 January 2009, La fabuleuse histoire du franc suisse.

- ^ a b c John Murray (1838). A hand-book for travellers in Switzerland and the Alps of Savory and Piedmont, including the Protestant Valleys of the Waldenses. London: J. Murray & Son.

- ^ Audin, Jean-Marie-Vincent (1843). Manuel du voyageur en Suisse en dans le Tirol | Monnaies.

- ^ "Newman Numismatic Portal at Washington University in St. Louis | Comprehensive Research & Reference for U.S. Coinage".

- ^ "Loi du 25 juin 1798". Bulletin des loix et décrets du Corps législatif de la République helvétique (in French). Henri Emanuel Vincent. 1798.

- ^ Swiss Confederation (1851). Feuille fédérale suisse (in French). Vol. 1. Stämpfli. p. 3. for Brabant ecus of 400 rappen (4 old francs) or 5-franc coins of 350 rappen, one computes at 7 old francs to 10 new francs. Hence CHF 40 = 28 old francs = 7 kronenthalers. Also on p. 3: Old franc = 1.4597 CHF.

- ^ "After the Gold Standard, 1931-1999" (PDF). World Gold Council.

- ^ Antweiler, Werner (2023). "Foreign Currency Units per 1 U.S. Dollar, 1950-2022" (PDF). PACIFIC Exchange Rate Service.

- ^ Gold.org Archived 22 July 2013 at the Wayback Machine, Declaration of the Swiss Government, through the Federal Finance and Customs Department, and the National Bank of Switzerland regarding the purchase and sale of gold, in Monetary History of Gold: volume 3 – After the Gold Standard

- ^ "Swiss Narrowly Vote to Drop Gold Standard". The New York Times. Associated Press. 19 April 1999. Retrieved 6 May 2012.

- ^ "Federal Law on Currency and Legal Tender to enter into force on 1 May 2000" (Press release). Efd.admin.ch. 12 April 2000. Archived from the original on 17 May 2013. Retrieved 20 September 2012.

- ^ "Speech by Philipp M. Hildebrand, Member of the Governing Board, Swiss National Bank" (PDF). Iie.com. 5 May 2005.

- ^ Bosley, Catherine (30 November 2014). "Swiss gold initiative vote". Bloomberg.

- ^ Bennett, Allison; Saraiva, Catarina (25 June 2001). "Swiss Franc Climbs to Record High on Greece Crisis". Bloomberg Businessweek. Archived from the original on 27 June 2011. Retrieved 18 March 2014.

- ^ Meier, Simone (10 August 2011). "SNB Steps Up Franc Fight to Counter 'Massive Overvaluation'". Bloomberg Businessweek. Archived from the original on 2 November 2012. Retrieved 18 March 2014.

- ^ "Francly wrong". The Economist. Economist.com. 10 September 2011. Retrieved 18 March 2014.

- ^ Mijuk, Goran (31 August 2011). "Swiss Short-Term Debt Yields in Negative Territory". The Wall Street Journal. Retrieved 22 June 2013.

- ^ "Swiss National Bank acts to weaken strong franc". BBC News. BBC.com. 6 September 2011. Retrieved 18 March 2014.

- ^ Wille, Klaus (6 September 2011). "Swiss Pledge Unlimited Currency Purchases". Bloomberg.com. Bloomberg News. Retrieved 18 March 2014.

- ^ "USD exchange rates | Bank of England | Database".

- ^ Weisenthal, Joe (6 September 2011). "THEY DID IT: Swiss National Bank Makes Epic Intervention Move, Sending The Swiss Franc Plunging". Business Insider. Businessinsider.com. Retrieved 18 March 2014.

- ^ Wearden, Graeme (6 September 2011). "Currency traders stunned by SNB intervention". The Guardian. London. Retrieved 22 June 2013.

- ^ Bennett, Allison (6 September 2011). "Franc Plunges Most Ever Versus Euro". Bloomberg.com.

- ^ Thomasson, Emma (6 September 2011). "Swiss draw line in the sand to cap runaway franc". Reuters.com. Retrieved 22 June 2013.

- ^ "Markets Reel after Swiss Franc Shock". primepair.com. 16 January 2015. Archived from the original on 19 January 2015.

- ^ "Franc Rises vs. Euro, Breaks Ceiling". Topforexnews.com. 5 April 2012. Retrieved 18 March 2014.

- ^ "Swiss central bank imposes negative interest rates". Yahoo Finance. 18 December 2014. Archived from the original on 5 March 2016.

- ^ "'Francogeddon': Swiss central bank stuns market with policy U-turn". Sydney Morning Herald. 16 January 2015. Retrieved 19 January 2015.

- ^ "'Francogeddon' as Swiss franc ends euro cap". BBC News. 16 January 2015. Retrieved 19 January 2015.

- ^ "'Francogeddon': New Zealand foreign exchange broker shuts after Swiss national bank scraps currency cap". Australian Broadcasting Corporation. 17 January 2015. Retrieved 19 January 2015.

- ^ "Swiss queue round the block to change currency as 'Francogeddon' continues". London Evening Standard. 16 January 2015. Retrieved 19 January 2015.

- ^ a b "Swiss franc soars as Switzerland abandons euro cap". BBC News. Retrieved 16 January 2015.

- ^ Inman, Phillip (15 January 2015). "Markets in turmoil as Switzerland removes currency cap". The Guardian. Retrieved 15 January 2015.

Currency and stock markets were thrown into turmoil across Europe

- ^ Wong, Andrea; Evans, Rachel (16 January 2015). "Swiss Franc Roils Markets as SNB Abandons Cap". Bloomberg. Retrieved 20 January 2015.

- ^ "The Swiss (Franc) isn't all that Neutral". Attain Capital Management. 15 January 2015. Archived from the original on 20 January 2015. Retrieved 19 January 2015.

- ^ "Alpari UK denies acquisition by FXCM, talks continuing". LeapRate. 18 January 2015.

- ^ "Alpari UK currency broker folds over Swiss franc turmoil". BBC News. 16 January 2015.

- ^ Kilgore, Tomi. "Leucadia to provide FXCM with $300 million loan". Marketwatch.

- ^ "Swiss franc fallout takes more casualties". Financial Times. 19 January 2015. Retrieved 20 January 2015.

- ^ "New Zealand forex broker shuts after Swiss franc move". Agence France-Presse.

- ^ (de) Jürg Richter and Ruedi Kunzmann, Neuer HMZ-Katalog, volume 2: "Die Münzen der Schweiz und Liechtensteins 15./16 Jahrhundert bis Gegenwart", (ISBN 3-86646-504-1)

- ^ SwissMint.ch Archived 5 February 2012 at the Wayback Machine, Mintage figures for Swiss coins as of 1850, status in January 2007.

- ^ "Frequently Asked Questions (D-27)". Swissmint. Last accessed 5 January 2017.

- ^ a b c d SwissMint.ch Archived 5 February 2012 at the Wayback Machine, Mintage figures for Swiss coins as of 1850, status in January 2007

- ^ "150 Years of Swiss coinage: From silver to cupronickel". Swissmint. Last accessed 2 March 2006. Archived 1 September 2005 at the Wayback Machine

- ^ "Our 10 cent coin enters the Guinness Book for its old age". PicaPica News. 15 April 2021. Retrieved 24 October 2023.

- ^ "Ordonnance sur la monnaie (Order on Currency)" (PDF) (in French). Government of Switzerland. 1 December 2012. Retrieved 18 March 2014.

- ^ "Circulation coins: Technical data". Swissmint. Last accessed 30 October 2006. Archived 5 December 2004 at the Wayback Machine

- ^ Cuhaj 2010, pp. 1135–36.

- ^ Cuhaj 2010, p. 1137.

- ^ Cuhaj 2010, pp. 1138.

- ^ "Sixth banknote series, 1976". Swiss National Bank. Retrieved 30 May 2018.

- ^ Blackstone, Brian (20 October 2017). "Switzerland's Old-Money Problem: One Billion in Expiring Francs". The Wall Street Journal. Retrieved 30 May 2018.

- ^ "Questions and answers on banknotes - What does 'the SNB is recalling banknotes from circulation' actually mean?". Swiss National Bank. Retrieved 30 May 2018.

- ^ "Seventh banknote series, 1984". Swiss National Bank. Retrieved 18 March 2014.

- ^ An overview of the security features Archived 12 October 2013 at the Wayback Machine, Swiss National Bank. Last accessed 20 September 2012.

- ^ "Eighth banknote series, 1995". Swiss National Bank. Retrieved 18 March 2014.

- ^ "National Bank remits Sfr 244,3 million to the Fund for Emergency Losses" (PDF) (Press release). Swiss National Bank. 4 May 2000. Retrieved 18 March 2014.

- ^ Friedberg, Arthur L. (10 May 2021). "Swiss National Bank recalls eighth series of bank notes". Coin World. Retrieved 8 June 2021.

- ^ "New banknotes for Switzerland". Zurich, Switzerland: Swiss National Bank SNB. May 2017. Retrieved 26 May 2017.

- ^ a b c "Banknotes and coins: The transition to a new banknote series". Zurich, Switzerland: Swiss National Bank (SNB). Retrieved 5 March 2019.

- ^ Triennial Central Bank Survey Foreign exchange turnover in April 2022 (PDF) (Report). Bank for International Settlements. 27 October 2022. p. 12. Archived (PDF) from the original on 27 October 2022.

- ^ a b "Swiss National Bank Monthly Statistical Bulletin" (PDF) (Press release). Bern: Swiss National Bank. February 2010. p. A2: Banknotes and coins in circulation. Retrieved 18 March 2014.

- ^ Art. 3 of the Swiss law on Monetary Unit and means of payment. Admin.ch (German), Admin.ch (French) and Admin.ch (Italian) versions.

Further reading

[edit]- Cuhaj, George S., ed. (2010). Standard Catalog of World Paper Money General Issues (1368–1960) (13th ed.). Krause. ISBN 978-1-4402-1293-2.

- Krause, Chester L.; Clifford Mishler (1991). Standard Catalog of World Coins: 1801–1991 (18th ed.). Krause Publications. ISBN 0873411501.

- Lescaze, Bernard (1999). Une monnaie pour la Suisse. Hurter. ISBN 2-940031-83-5.

- Pick, Albert (1994). Standard Catalog of World Paper Money: General Issues. Colin R. Bruce II and Neil Shafer (editors) (7th ed.). Krause Publications. ISBN 0-87341-207-9.

- Rivaz, Michel de (1997). The Swiss Banknote: 1907–1997. Genoud. ISBN 2-88100-080-0.

- Swissmint.ch 150 Years of Swiss coinage: A brief historical discourse. Last accessed 2 March 2006.

- Swissmint.ch; Prägungen von Schweizer Münzen ab 1850 — Frappes des pièces de monnaie suisses à partir de 1850, 2010.

- Wartenwiler, H. U. (2006). Swiss Coin Catalog 1798–2005. ISBN 3-905712-00-8

- Wenger, Otto Paul (1978). Introduction à la numismatique, Cahier du Crédit Suisse, August 1978. (in French)

External links

[edit] Media related to Money of Switzerland at Wikimedia Commons

Media related to Money of Switzerland at Wikimedia Commons- (in German) CashFollow.ch, Swiss Franc Tracker

- (in German) Schweizer-Franken.ch Archived 18 October 2018 at the Wayback Machine, Information about the Swiss Franc

- (in English) Switzerland Banknotes, Swiss Franc: Banknote Catalog from 1907

- (in English and German) The Banknotes of Switzerland

- Franc – currency at Merriam-Webster